As required under Rule 203 of the CPA Code of Professional Conduct, “A member shall sustain professional competence by keeping informed of, and complying with, developments in professional standards in all functions in which the member provides professional services or is relied upon because of the member’s calling”.

The actual CPD model places the onus on each member to determine their professional development needs and how to address them through a variety of CPD activities. Members are asked to focus on the outcome of CPD activities as opposed to the time spent on them.

CPA New Brunswick’s Continuing Professional Development requirements, as presented below, are closely aligned with the nationally recommended requirements of CPA Canada and also meet the international educational standards (IES 7 and IES 8) of the International Federation of Accountants (IFAC).

Definitions

Continuing Professional Development (CPD)

CPD is learning that develops and maintains professional competence to enable members to continue to perform their professional roles. Any learning and development that is relevant and appropriate to a member’s work and professional responsibilities and growth as a CPA will qualify for CPD.

CPD includes verifiable and unverifiable learning activities.

Verifiable CPD hours

Verifiable CPD refers to learning activities that can be tangibly and objectively verified. Learning activities that result in evidence that the learning activity was undertaken are considered “Verifiable”.

Unverifiable CPD hours

Unverifiable CPD refers to learning activities that cannot be tangibly and objectively verified.

“Unverifiable” learning activities do not result in evidence that the learning activity was undertaken.

Prime Membership/Province

Prime refers to where members pay their CPA national fees. Members who primarily live and work in New Brunswick are required to pay their CPA national fees in New Brunswick.

Additional Guidance

Volunteer or pro‐bono work may only qualify as verifiable or unverifiable CPD to the extent it meets the above definitions.

Category of members

For the purposes of CPD reporting, Members are categorized as either “Active”, “Inactive,” or Non-resident Members.

Active Member

An Active Member is a member who is engaged in the workforce, self‐employed, providing professional services to clients or seeking employment, or a member serving on a board or similar governing body, or an audit, finance or similar governance committee of a public company, reporting issuer, or of a large or prominent organization based on the criteria determined by CPA New Brunswick such as (but not limited to) large or prominent charities, foundations, associations, hospitals, health authorities, publicly funded educational institutions and social service agencies.

Active Members with prime membership in CPA New Brunswick are required to fully adhere to the CPD provisions herein. Non-resident Members will be required to declare compliance with the CPD requirements in their prime province.

Inactive Member

An Inactive Member shall be one who is unable to maintain an active membership due to permanent or temporary personal circumstances. Circumstances leading to an inactive membership categorization may include recognized leave of absence from employment such as medical, maternity, and paternity leave.

Non-resident Member

A non-resident member is a member who maintains their prime membership with another province other than CPA New Brunswick. Such members pay their CPA national and provincial fees to another provincial body.

a) Permanently Inactive Member

A Member who is considered permanently Inactive has no expectation of returning to active status. Examples of a Permanently Inactive Member include a Member who:

- Is Retired; or

- Is Infirm, in cases where a member is permanently withdrawn from employment and other professional activity due to a long‐term critical, terminal or chronic medical condition.

A Retired Member shall be a former Active Member who wishes to maintain the CPA designation but is no longer working.

b) Temporarily Inactive Member

A Member who is considered temporarily inactive is one who has a reasonable expectation of returning to active status at some point in the future. Examples of a Temporarily Inactive Member include a Member who:

- Is on Maternity/Paternity leave;

- Is caring for a child or children;

- Is caring for a family member with a critical, terminal or chronic medical condition;

- Has a personal medical illness or condition.

All applications for exemption need to be evidenced by a medical certificate or other supporting documentation, for a continuous period not to exceed 5 years.

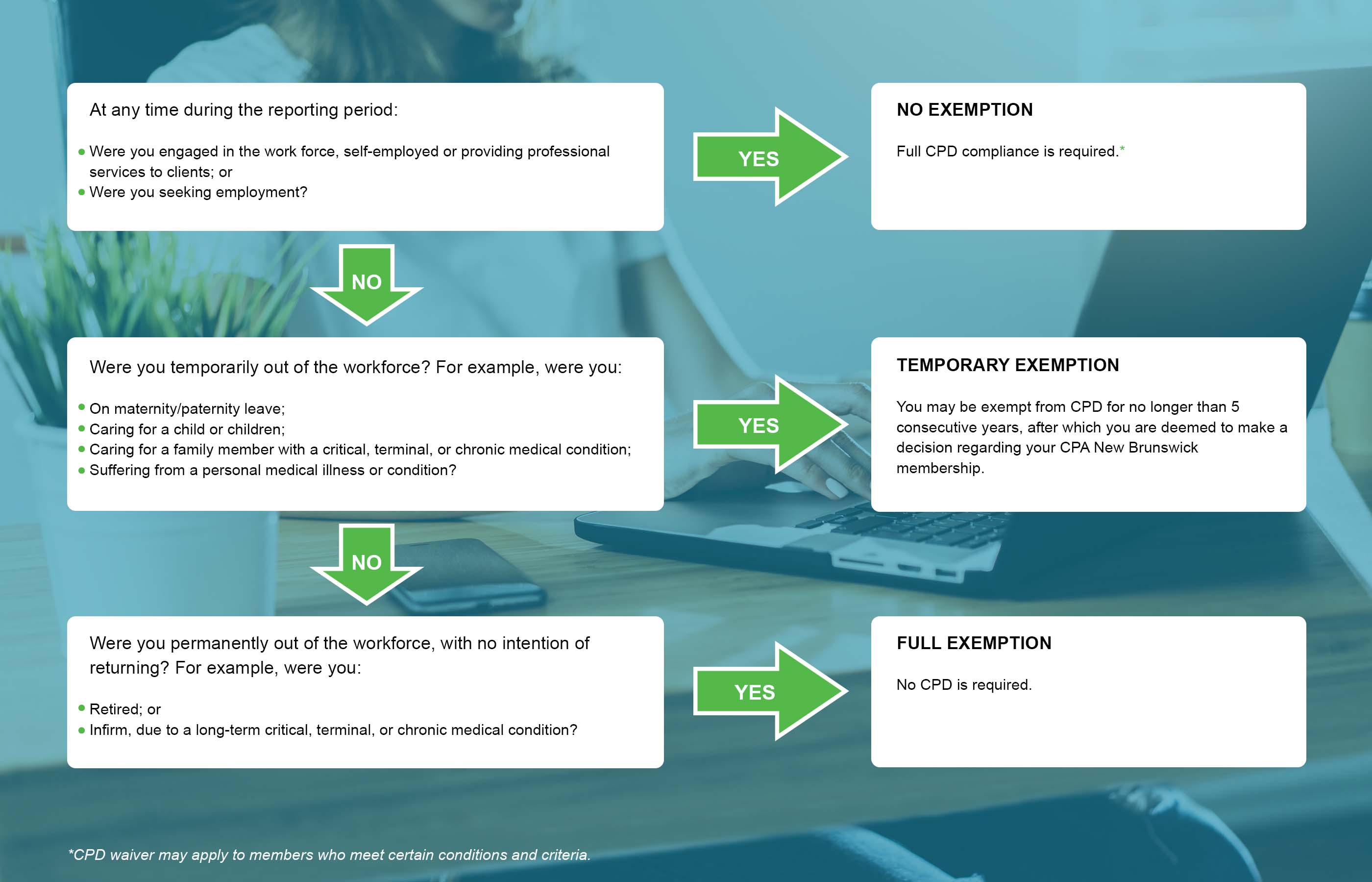

Inactive Members are either temporarily or fully exempt from CPD requirements. See the CPD exemption Model in Appendix A to determine if a member is an Active Member or an Inactive Member.

Completion requirements

Every CPA Active Member shall complete a minimum of 120 hours of CPD every three-year rolling period, including a minimum of 20 hours annually.

A minimum of 60 hours of CPD over the three-year rolling period must be verifiable, which shall include 4 hours of verifiable learning in professional ethics. Annually, a minimum of 20 CPD hours must be completed, which includes 10 hours of verifiable learning and 10 hours of non-verifiable learning.

If the minimum hours described above is completed in a year, a member will be required to complete more hours in the following year(s) to make up the requirement for the three-year rolling period.

A maximum of 40 CPD hours may be carried over from one period to the next to cover the minimum requirement hours.

Declaration for Audit Practice Leaders (Tier 1 [Audit] PermitT)

Practitioners initially requesting or renewing Tier 1 public practice permit are required to complete an annual self-assessment and declaration that they have undertaken sufficient relevant CPD to develop and maintain professional competence for their role. This requirement is the result of revisions to International Education Standard 8: Audit Engagement Partner Competence.

New members

New members joining the provincial body either through a Canadian certification program or Mutual Recognition Agreement/Reciprocal Mutual Agreement/Memorandum of Understanding will be required to complete full CPD requirements in the year of admission to membership. However, they will be permitted to report learning activities that occurred within the reporting year, prior to registration as a member, including PEP modules, CPA Reciprocity Professional Development (CPARPD), Overview of Canadian Tax and Law etc.

Compliance reporting requirements

On or before March 31 of every year, every Active Member shall complete their CPD reporting during the membership renewal process with a simple perfunctory annual declaration of compliance. If you are a member of more than one provincial CPA body, please contact the other bodies to ensure that you meet all CPD requirements.

Every Active Member shall retain documentation to support the verifiable learning activities for at least five years from the date of reporting.

Verifiable CPD documentation should:

- Describe the learning activity;

- Identify the provider of the activity, where applicable;

- Connect the member to the activity;

- Identify when the activity took place; and

- Provide a basis for concluding that the number of reported hours is reasonable.

Such documentation may include certificates of completion, transcripts, evidence of attendance at conferences and seminars, published work, presentations, reports or other such documentation or evidence of completion as may be available. Some evidence may require further validation by a superior/independent person that was involved in the activity.

On an annual basis, CPA New Brunswick will randomly audit a sample of member CPD reporting.

Exemption from CPD requirements

An application for exemption from CPD requirements by Permanently or Temporarily Inactive Members must be completed in writing. The written application, with supporting documentation, shall be submitted to the Registrar for approval. The exemption request by Temporarily Inactive Members must be submitted for approval annually.

Inactive Members who have been exempted from the CPD requirements in excess of thirty-six (36) consecutive months must, upon transition to an Active Member status, submit to CPANB in a timely manner, a CPD plan which will develop the current competencies necessary to support the member’s transition to Active Member status.

CPD exemptions are established as separate and distinct from fee waivers.

Non-compliance with CPD requirements

In the event of non‐compliance, the following steps will be followed:

- A notice of non‐compliance will be sent advising the Member that should they remain non-compliant, they will be suspended. Furthermore, it would indicate the timing of suspension and the ramifications of such suspension. The notice will also advise the Member of the deadline to become compliant.

- In the event that the person who received the notice of non‐compliance fails to provide the required documentation within thirty days after the date of notice as mentioned in the section above, a suspension letter will be sent to the Member, which describes the ramifications of being suspended and what needs to be done to be reinstated.